Gemini Exchange Review:

In this Gemini exchange review we give a non biased review of Gemini, a crypto exchange and share details about features, fees and our overview of their site.

Disclaimer: Under NO circumstance should this review be interpreted as a recommendation to trade or an endorsement of a trading platform, supplier or of a specific cryptocurrency.

Gemini Exchange Review – QUICK NAVIGATION

QUICK FACTS – Gemini Crypto Exchange

Type: Trading platform/crypto exchange

Founder: Tyler and Cameron Winkelvoss

Headquarters: New York, USA

Gemini Exchange Review:

Overview of Gemini

The Gemini cryptocurrency exchange was founded in 2014 by the Winkelvoss twins who have made quite a name for themselves in the industry. They took an early bet on Bitcoin in the very beginning and made hundreds of millions of dollars by some astute trading. Gemini was also the first exchange to launch futures contracts in late 2017 – a decision that was said to have led to the price crash of the crypto market. It was also the target of hackers over the years but security has been beefed up considerably through a complex system of private keys. It is registered in New York.

Gemini Exchange Bonuses: Sign up bonus

Gemini does not have a sign up bonus at present

Trading on Gemini Exchange

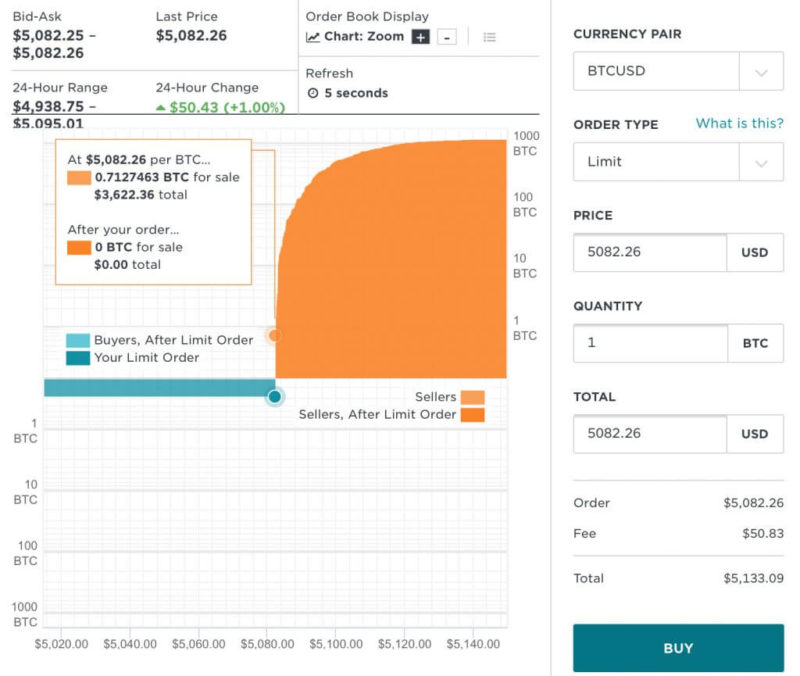

There are currently two trading options on the Gemini trading exchange which are through the Continuous Order Book and the Auction option.

How to place a Trade

To buy and sell cryptocurrency on Gemini you just need to follow the next steps:

- Login to your Gemini account

- Click on buy

- Choose a currency pair

- Continuous book screen will appear

- Select trade amount

- Follow advance pricing chart

- Form will autofil

- Click on Buy

Bitcoin Futures

Gemini offer an ‘auction trading option’. This function is mostly for advanced traders and the CBOE to set the price for its bitcoin futures. An advantage in the sometimes illiquid cryptocurrency markets is the ability to enter the market when a pool of liquidity will be aggregated.

Margin Trading

No margin trading is currently offered.

Fees on Gemini Exchange

Whilst deposits are free and there is no charge for the first 30 monthly withdrawals, there are fees for buying and selling on this exchange, which start at 1% and lower based on volume traded.

30-day Trading Volume (USD)

| Amount | Taker Fee | Maker Free | Auction Fee |

| – | 1.00 % | 1.00 % | 1.00 % |

| >$25,000 | 0.75% | 0.75% | 0.75% |

| >$50,000 | 0.50% | 0.25% | 0.25% |

| >$500,000 | 0.25% | 0.15% | 0.15% |

| >$5,000,000 | 0.15% | 0.15% | 0.15% |

| >15,000,000 | 0.10% | 0.0% | 0.0% |

Uniquely we see trading fees on mobile trades, this is specifically useful for non professional traders who are trading on much lower amounts. Fees range from 0.90c and then go up based on the trade volume. This captures individuals trading under the thresholds above and strictly on mobile.

Mobile Order Amount Transaction Fee

| Up to $10 or less | $0.99 |

| Between $10 & up to $25 | $1.49 |

| Between $25 up to $50 | $1.99 |

| Between $50 up to $200 | $2.99 |

| $200 + | 1.49% of mobile value order |

Withdrawal on Gemini

The withdrawal process on Gemini is quite straightforward. From the side menu, just click on Withdrawal Funds, then click on Bank Transfer or the coin you want to withdraw.

To withdraw monies back to a bank account via bank transfer, your bank account must be verified, once that is done this process is simple but monies can take up to 5 days to land in your account.

User Experience on Gemini

Navigation

Navigation is quite easy to get around since the number of markets is limited.

Charts

Charts are very basic and do not have dark options. They are not customisable and have no dark options.

Offerings/Markets

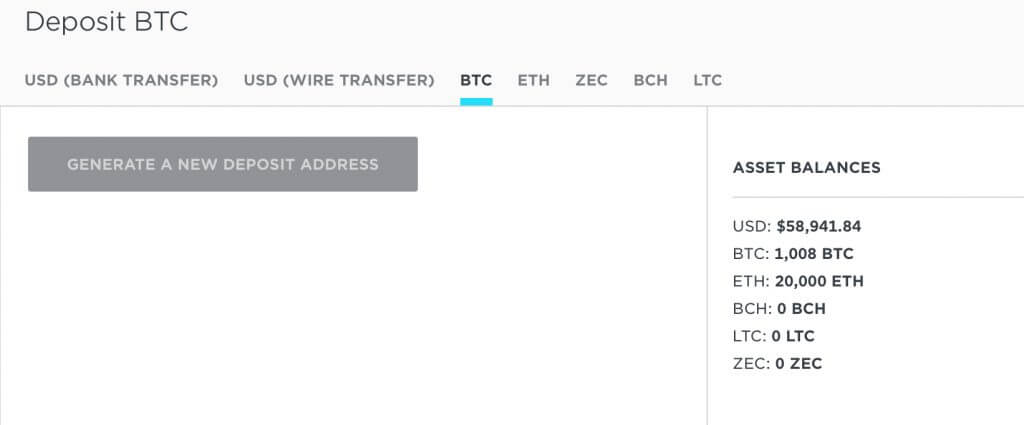

Five markets are currently offered. These are BTC, ETH, LTC, BCH and ZEC. Governance around listings is quite strict as Gemini have a license to trade each currency.

Other products

At present Gemini does not offer any other products apart from the normal crypto trading options.

Mobile Experience

There isn’t much difference from the main desktop site and it is quite simple to navigate around.

Security

When it comes to security, Gemini holds client crypto in its own virtual vault. This is quite rare amongst exchanges. For further safety this crypto is stored offline and in cold storage.

Governance

Gemini is headquartered in New York and has an undisclosed number of employees. They only provide normal cryptocurrency exchange services. Their wallet is very secure as mentioned before and they are privately owned.

Support & Social

Whilst they offer support via FAQs on their site and a series of tutorials are available, dedicated support is limited to a normal email request and there is no chat option. To get persona support you would need to submit a ticket to a support contact.

For Social media you can read out on Gemini’s blog, Medium and other social media accounts such as Telegram to keep updated on new features.

Gemini Exchange Review: Our Rating

By means of the Gemini exchange review we noticed a few advantages about Gemini. The most apparent are it being a fully licensed crypto exchange with fast sign up and Gemini Sandbox simulated trading. Low fees, a secure exchange and multi-currency wallet as well as strong institutional trading features and custody services make up the more obvious pros.

On the negative side, there are only half a dozen coins traded, few trader educational resources and limited deposit options. Whilst there are API plug-ins for pro traders there are few technical indicators for the novice. Additionally, Gemini holds users’ private keys and it is a rather complex interface for the beginner. Since it is a centralized crypto asset solution, Gemini is vulnerable to hacking and phishing attacks.