Free Crypto Course Session 2: Bitcoin

Bitcoin Definition

A type of digital currency that functions independently of a central bank and maintains a record of transactions while also generating new units of currency through the computational solution of mathematical problems.

“It’s a new online currency that’s been developed. It’s just like actual money, except you can’t see it, hold it or spend it on anything. […] You can mine it. […] There is a limited amount and we find it not by tunnelling into the earth, but by using a computer to solve complex mathematical problems.”

Key Points

- Created anonymously in 2009 by Satoshi Nakamoto

- “Bitcoin” the blockchain vs. “bitcoin” the coin

- The first block was called genesis block

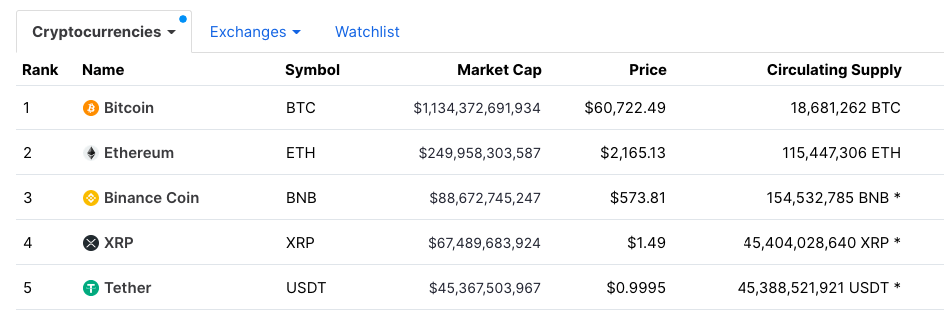

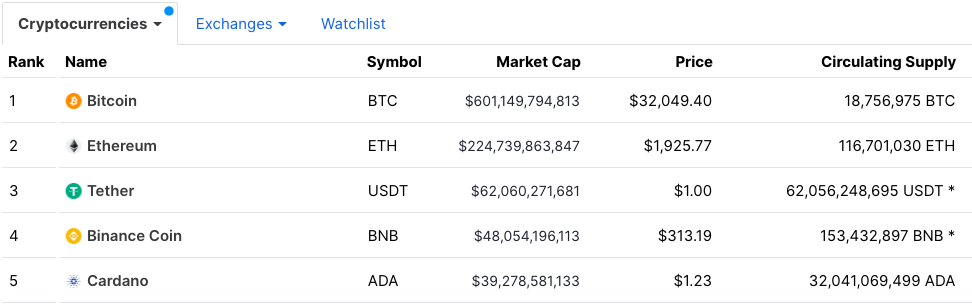

- In 2021 Bitcoin remains the world’s leading Cryptocurrency, followed by Ethereum (ETH) and Binance (BNB)

- It is a decentralised currency, which means they are not issued by any entity and cannot be outlawed.

- Bitcoin transactions cannot be reversed, they are immutable.

- Large amounts of bitcoin are held by whales.

- Some people like to hodl bitcoin since they consider it a rare commodity.

Bitcoin’s Governance

- There’s a limited amount of Bitcoin.

- When Bitcoin was founded, the creator only made 21 million of it.

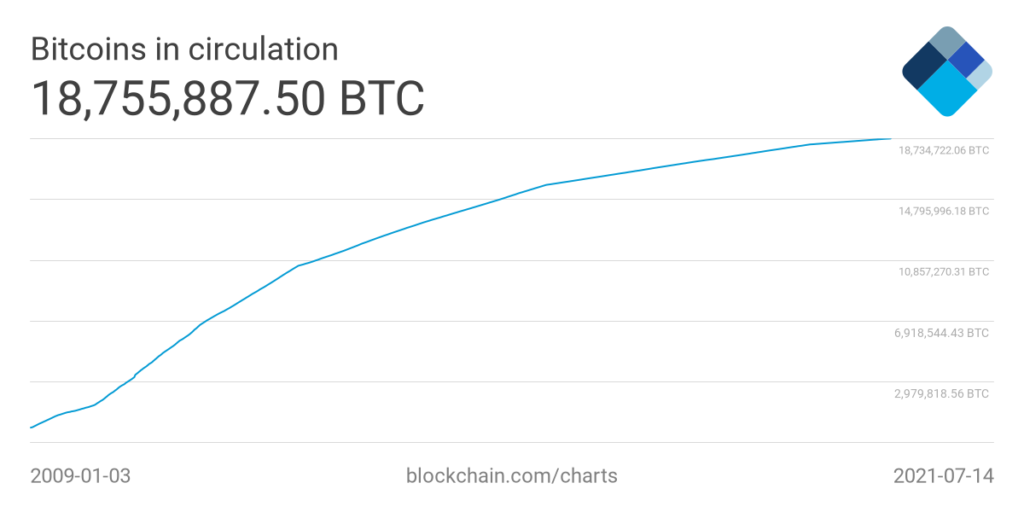

- Right now, over 18 million Bitcoin are in circulation.

- The number or bitcoin “released” through mining reduces over time.

- Over time, the computation becomes harder to solve.

- Predictively, it will take until 2041 for all bitcoin to be mined.

- A new Bitcoin block is build every 10 minutes.

Bitcoin Characteristics

- Bitcoin addresses are a long strings of up to 35 alphanumeric characters.

- You keep bitcoin in a wallet

- Under this address, know as a key, the identities of the sender and recipient are kept anonymous.

- If you lose your key, you’ve lost your bitcoins!

- It is believed that aprox 20% of all the bitcoin supply is “lost”.

- Bitcoin is highly volatile.

- It is created through mining.

- Bitcoin can be regarded as one of the most significant technical breakthroughs of the twenty-first century.

- One of bitcoin is called a “Satoshi byte” – 1 Satoshi byte is worth 0.00000001 bitcoin

- Bitcoin ATMs are now available worldwide.

- Fun fact: The FBI is the owner of one of the world’s biggest Bitcoin wallets (1.5% of all bitcoins)

‘’Bitcoins are amounts associated with addresses, unique strings of letters and numbers. 1Ez69SnzzmePmZX3WpEzMKTrcBF2gpNQ55 represents nearly 30,000 Bitcoins seized during the Silk Road bust—worth about $20 million at the time—that were auctioned off by the U.S. government on 1 July 2014’’

The Million – Dollar (Bitcoin!) Question:

Is Bitcoin Anonymous?

- Bitcoin is completely transparent. Thus, it would be ironic for it to also be anonymous.

- Instead, it is pseudonymous. This means it’s anonymous, but only up to a certain degree.

“Bitcoin is designed to allow users to send and receive payments with an acceptable level of privacy as well as any other form of money. However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash’’

Is Bitcoin Money?

- Properties of money:

- Money is a store of value

- Money is a unit of account

- Money is a medium of exchange

- There are many arguments about whether Bitcoin is money or not

- Essentially, for something to be classified as money, it needs to be considered “legal tender”.

- While some countries now recognise bitcoin as legal tender, the majority of countries still regard it as a commodity.

History of Bitcoin

How Does Bitcoin Work?

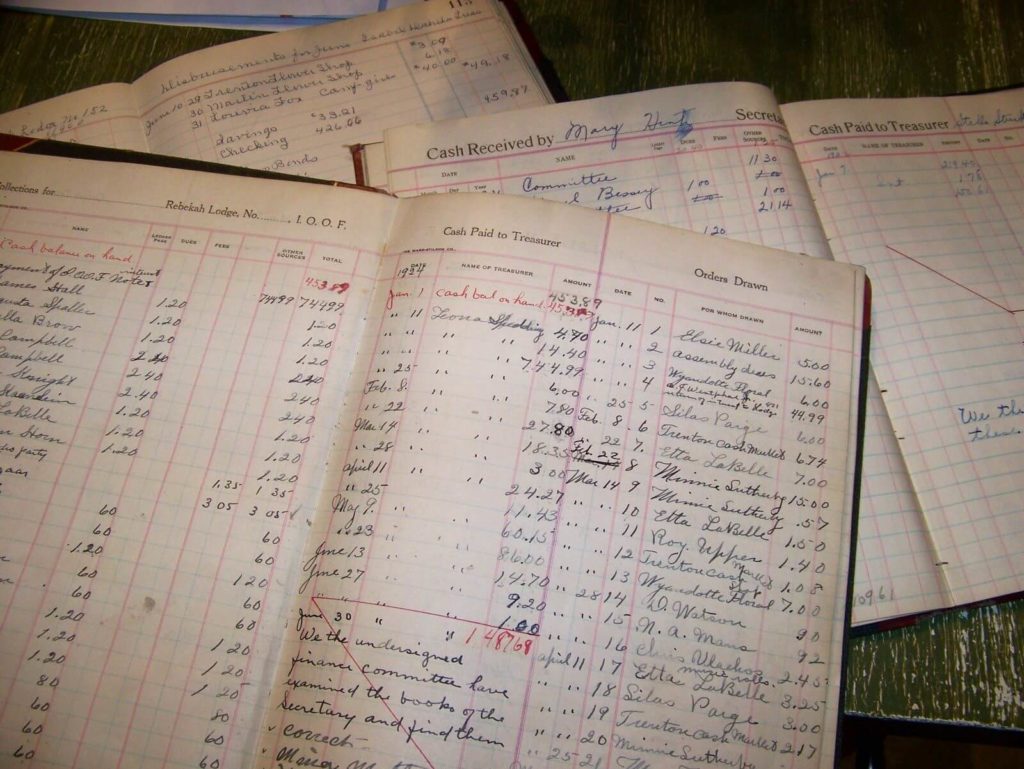

Bitcoin Mining

Is the process of generating new bitcoins through computational algorithms.

Key Points

- The term “mining” is a poor analogy for what “miners” do.

- It would make a lot more sense if you think of the miners as bookkeepers.

- Bitcoin mining process serves two purposes:

- It creates new bitcoins in each block

- And confirms transactions

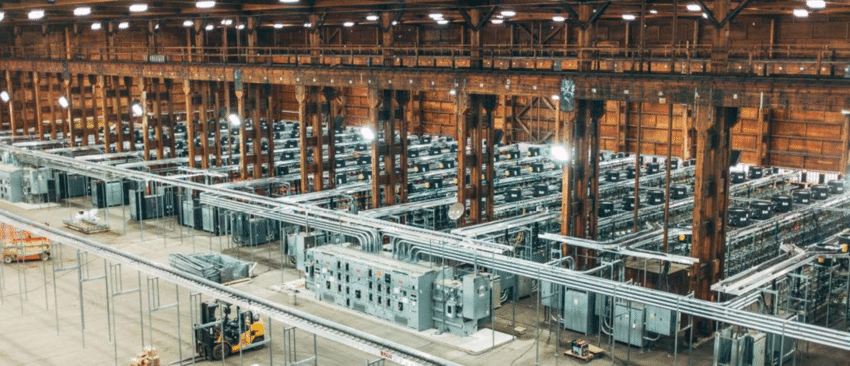

- Bitcoin mining requires a lot of energy, hardware and bandwidth.

- As a result, if you intend to do this at home, the cost of electricity would almost certainly outweigh the value of the bitcoins you will mine.

- To mine successfully, you need to have a high “hash rate,” which is measured in terms of megahashes per second (MH/s), gigahashes per second (GH/s), and terahashes per second (TH/s).

Think record keeping and verifying…

… not this!

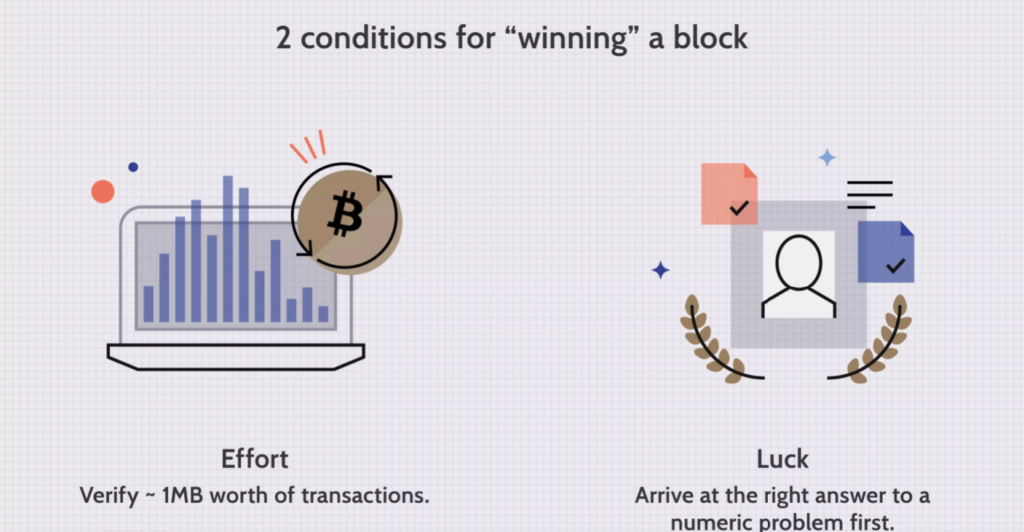

How Bitcoin Mining Works

- Miners gather and broadcast their transactions in a block, which they then verify are legitimate.

- They apply the previous block’s header’s cryptographic hash function to the new block.

- Then, they try to solve the Proof of Work dilemma.

- Winning/Losing – The winning block is broadcast to all other clients as a verified transaction block. The client nodes check that the hash matches the required pattern and accept the new block, which is then added to the existing blockchain that they all maintain.

- Notice that blockchain refers to a series of blocks (!)

Proof of Work Problem

- To prevent wasteful or malicious use of the device, miners must demonstrate that they have placed considerable effort into solving complex mathematical problems.

- The time and energy required to run the computer hardware and solve complex equations is part of said effort.

- How it works:

- Hash of Last Block Header + Block of New Transactions + Random Number (Nonce = 32-bit number)

- Apply Cryptographic Function (SHA-256) to the above data

- Hash is compared to a predetermined value.

- Less than this value = Prize.

- Not less = Guess Nonce Again & Repeat

- Winning Block Verified by Nodes as a Block and broadcasted to the network

Image by Sabrina Jiang © Investopedia 2021

51% Attack

- When a 51% attack occurs on a blockchain, a single person or organisation gains control of the majority of the hash rate, potentially disrupting the network.

- In this was the case, the attackers would have enough power to exclude or change the order of transactions on purpose.

- They would also be able to stop new transactions from being confirmed, effectively halting transfers between any or all users.

- They could potentially double-spend coins, as they could undo transactions that had already been made while in charge of the network.

Examples of Crypto Mining Farms Around the World

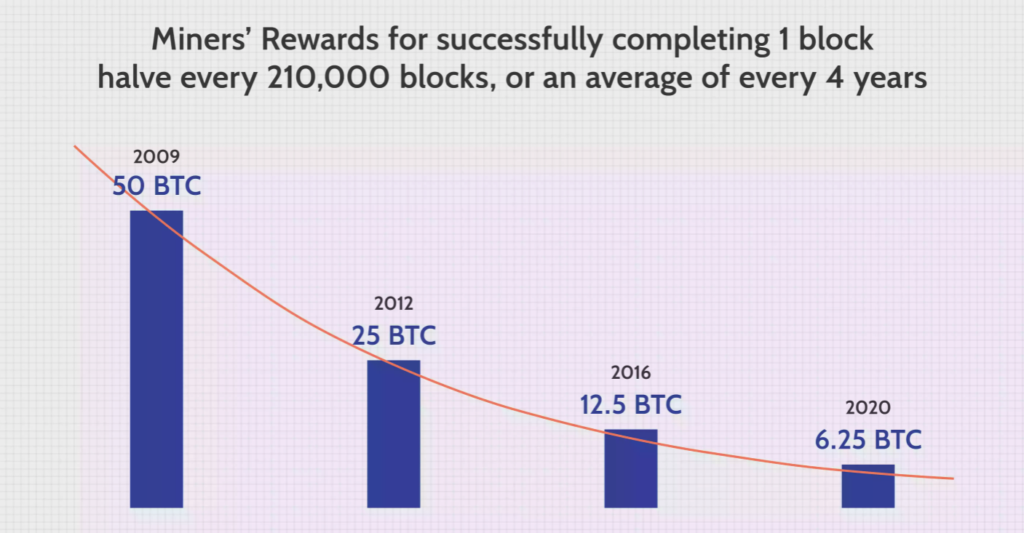

Bitcoin Halving

When the reward for mining Bitcoin transactions is cut in half, it is known as a Bitcoin halving.

Key Points

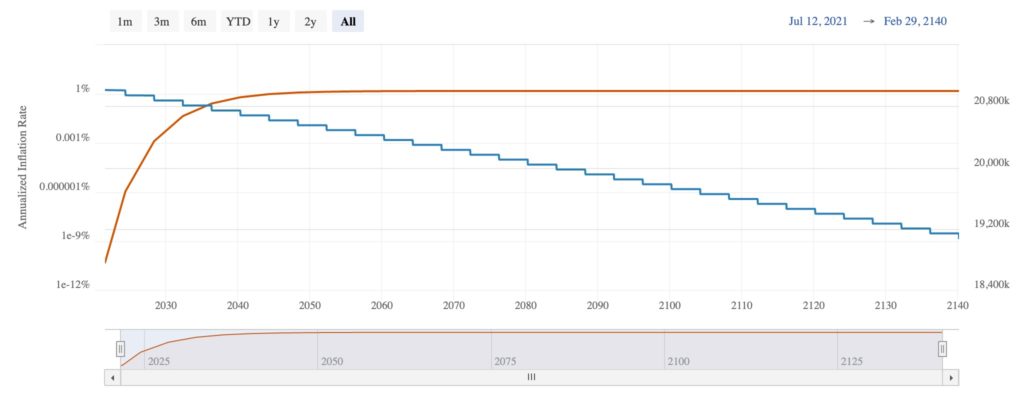

- The block reward offered to Bitcoin miners for processing transactions is cut in half every 210,000 blocks mined, or approximately every four years.

- Inflation and the pace at which new Bitcoins enter circulation are both cut in half as a result of the halving.

- Both recent halvings have been linked to extreme boom and bust cycles, with prices ending up higher than they were before the event.

- The reward for each block mined in the chain was 50 Bitcoins in 2009. After the first halving, it was 25, then 12.5, and as of May 11th, 2020, it was 6.25 Bitcoins per block.

Image by Sabrina Jiang © Investopedia 2021

Future of Bitcoin Halving

- A halving event is important, because it means another reduction in the limited supply of Bitcoin.

- Bitcoin has a maximum supply of 21 million coins.

- This system will be in place until about the year 2140.

- After that, miners will be paid fees for processing transactions.

- These payments ensure that miners continue to be motivated to mine and maintain the network.

- The theory is that after the halvings are completed, there will be enough competition for these fees to keep them minimal.

Bitcoin Price

The price of bitcoin is influenced by the following factors:

- Supply and demand

- Cost of production (mining process)

- Rewards to miners

- Exchanges

- Regulations

- Internal governance

- Whale movement

- Pump and dump activity

- Media exposure

Supply and Demand

- The supply of bitcoin is impacted in different ways.

- First, as miners process blocks of transactions, new bitcoins are added into the market, and the rate at which new coins are introduced is programmed to slow down over time.

- Growth decreased from 6.9% in 2016, to 4.4% during 2017 to 4.0% in 2018.

- This can lead to situations where demand for bitcoins grows faster than supply, causing the price to rise.

- The halving of block rewards provided to bitcoin miners has slowed the development of bitcoin circulation.

- Second, the amount of bitcoins that the system allows to exist can have an effect on supply (21 million can be ever mined).

- In December 2020, the supply of bitcoin reached 18.587 million, accounting for 88.5% of the total supply of bitcoin accessible.

- Once the full amount of bitcoins is in circulation, prices will depend on its practicality, legal status and popularity compared to other cryptocurrencies.

Cost of Production

- Bitcoins and other cryptocurrencies are expensive to produce – by far, the most important factor is the electricity consumption.

- Bitcoin miners compete against each other in a race to solve a difficult cryptographic math problem. The first one to do so is rewarded with a block of newly minted bitcoins as well as any transaction fees accrued since the last block was discovered.

- In order to maintain the block time, the math problem has to be of a certain complexity, but the sharp competition increases said complexity even more, making it, in exchange, more expensive.

Availability on Currency Exchanges

- The more successful an exchange becomes, the more likely it is to attract new users.

- By using its market clout, it can potentially set the rules on how other cryptocurrencies are added in the future.

Competition

- As of March 2021, bitcoin remains the dominant cryptocurrency in terms of market capitalization.

- Altcoins such as Ethereum (ETH), Tether (USDT), Binance Coin (BNB), Cardano (ADA) and Polkadot (DOT), are among the main rivals of bitcoin.

- A vast competition is always good news for investors as it keeps costs down.

- Bitcoin, fortunately, benefits from its popularity, which gives it an advantage over its rivals.

Regulations and Institutional Acceptance

- Because of the rapid increase in popularity of bitcoin and other cryptocurrencies, regulators are debating how to define them.

- This can have two effects on markets.

- Growing demand:

- Bitcoin is accessible to buyers who otherwise would not be able to afford to buy one

- Driving institutional acceptance

- Tesla and other Fortune 500 businesses add Bitcoin to their balance sheets

- Visa, Mastercard and PayPal add support for crypto payments

- Growing demand:

Forks and Governance Stability

- Software updates might frustrate the bitcoin community since they take a long time to address and need to be consensus-driven.

- The number of transactions that can be processed is determined by block size, and, currently, bitcoin software can only process about three transactions per second.

- Bitcoin is notorious for its slow transactions, which can push investors towards other faster cryptocurrencies. With the demand of cryptocurrencies, this concern has grown in the recent years

- A modification to the laws controlling the underlaying software, are called “Forks”

Forks

Bitcoin forks are splits in the transaction chain that occur as a result of differing user views on transaction history.

Key Points

- A Bitcoin fork changes the rules that Bitcoin must fulfil.

- Miners of that particular Bitcoin blockchain can opt to obey one set of rules or opt for the other ones, with the new rules implemented.

- Without sacrificing the original product, forks allow for a different development structure within the Bitcoin framework.

- As Bitcoin became more popular, the original 1-megabyte blocks, proved to be restricting.

- If a larger block undergoes a fork, it will result in a completely new and independent cryptocurrency.

- Forks are similar to institutional splits, with one portion of a corporation going in one direction and the other moving in the opposite one.

- Just a few of the nearly 100 bitcoin forks that have occurred to date have managed to gain traction in the altcoin market.

- Bitcoin Cash, Bitcoin SV, and Bitcoin Gold are three of the most well-known.

- Each of them operates independently and follows its own set of rules.

- They are cryptocurrencies, but they are not identical to Bitcoin.

Soft Forks vs. Hard Forks

Soft Forks

- Instead of modifying the final product, a soft fork modifies the Bitcoin protocol.

- The soft fork can be used in both directions.

- This ensures the old nodes in the system would accept the new protocol.

- It also means that no new product is being released.

Hard Forks

- Hard forks are newer Bitcoin versions that are entirely different from the original.

- After a hard fork, there are no transactions or interactions between the two forms of Bitcoin.

- They are distinct from one another, and the transformation is permanent.

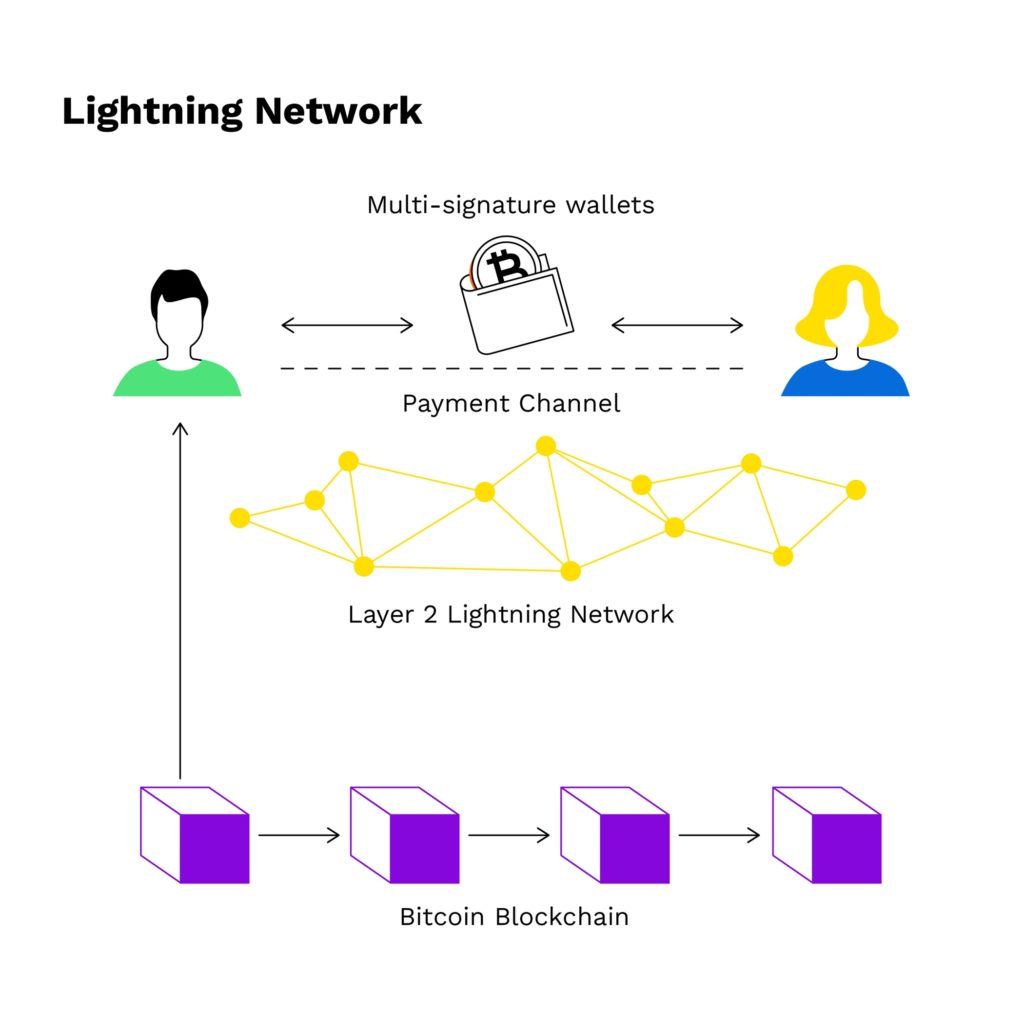

Lightning Network

The lightning network is a bitcoin second layer solution that employs micropayment channels to increase the blockchain’s ability to process transactions quicker.

Key Points

- The idea behind it is that not every single transaction on the Blockchain needs to be recorded.

- The Lightning Network opens a channel when two people make multiple transactions between them.

- The Blockchain then only records the opening of said channel.

- Participants can make as many transactions as they want until one of the members decides to close the channel.

- The final balance of the transactions done while the channel was open, will be recorded in the Blockchain.

How does the Lightning Network work?

- When a payment channel is opened, the funds that are going to be transferred are locked in it, like in a vault.

- To open said channels, the participants have to commit a certain amount of Bitcoins.

- The two parties exchange a “promise of ownership” for that quantity of bitcoins.

- The channel can be closed at any time, would one of the participants wish to do so.

- Once the channel is fully closed, the final balance is recorded into the Blockchain.

Source: Blockgeeks.com

Bitcoin Fun Facts!

Who is Satoshi Nakamoto?

- Anonymous creator of Bitcoin

- Could have been any person, group of people, financial institution or even a government.

What is the Bitcoin Bible?

- Satoshi Nakamoto produced the original whitepaper in 2009.

- It’s called “Bitcoin: A Peer-to-Peer Electronic Cash System

- You can find it online: https://bitcoin.org/bitcoin.pdf

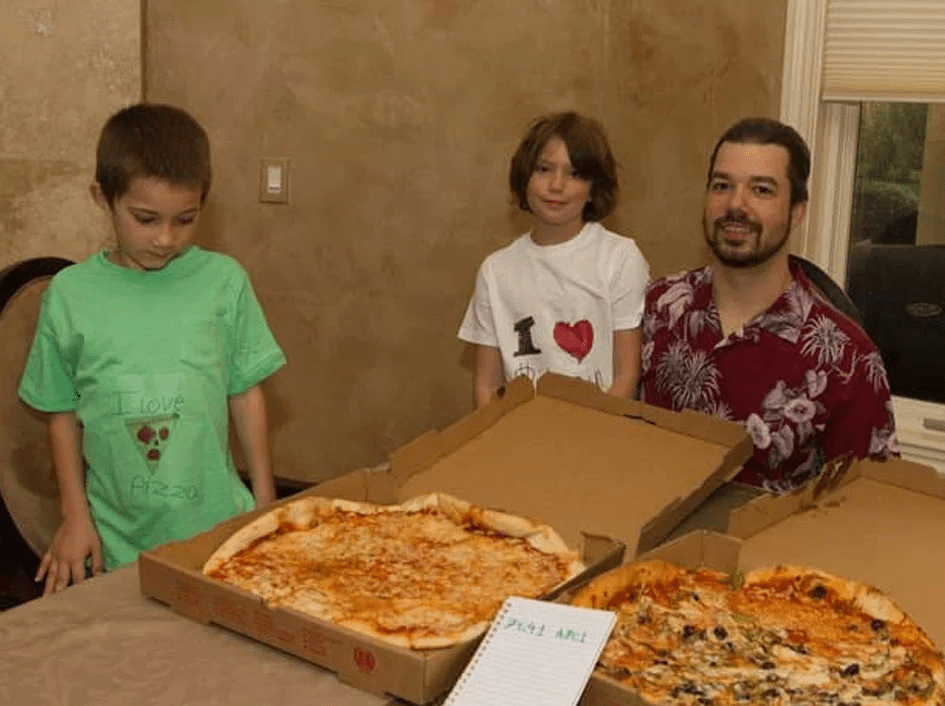

Bitcoin Pizza Day – 22nd of May

- On May 22, 2010, the first real- world transaction with bitcoin happened.

- Laszlo Hanyecz, a programmer from Florida, traded 10,000 bitcoins for two Papa John’s Pizzas.

- At that particular time, 10,000 Bitcoins were worth approx. $41.

- Now, these 10,000 Bitcoins are worth over $64 million.

Liberland

- In April 2015, Vít Jedlička, founded Liberland.

- It’s a micronation between Croatia and Serbia.

- The founder is a politician, publicist, activist and, now, president of Liberland.

- Bitcoin is the official currency of Liberland.

- It has since then been removed from google maps, but you can still find it here.

What is Digicash?

- Digicash was the firs cryptocurrency to ever exist.

- In 1989, David Chaum created Digicash based on cryptographic protocols.

- Unfortunately, it wasn’t popular enough and never got materialised.

Bitcoin Metrics

Cryptocurrency Price Fluctuations

Print Date: April 13th 2021 – Source: CoinMarketCap.com

vs.

Print Date: July 15th 2021 – Source: CoinMarketCap.com

Bitcoin Price Historical Chart

Print Date: July 15th 2021 – Source: BitcoinAverage.com / CoinMarketCap.com

Bitcoin Market Cap

Print Date: July 15th 2021 – Source: CoinMarketCap.com

Total Bitcoin Supply

Print Date: July 15th 2021 – Source: Blockchain.com

Cryptocurrencies in the Market

Print Date: July 15th 2021 – Source: BitcoinVisuals

Bitcoin Future Supply

Print Date: July 15th 2021 – Source: BitcoinVisuals