When it comes to the future, Blockchain is an emerging technology that’s likely to be central to the digital revolution that’s just starting to gather pace across the world. In simple terms, blockchain can be defined as a digital network that facilitates the sharing of value, such as payments between people online. Our look into the realm of blockchain, will give you a deeper insight into what blockchain really is and why investing in this exciting niche, could be a great opportunity.

Blockchain can be defined as a bit of software that facilitates the sharing of value, such as payments between people online.

Blockchain Basics

In 2020 and 2021, the rise of digital assets such as Bitcoin and Ethereum, infamous cryptos like Dogecoin, and emerging projects such as Cosmos, have gained traction across all forms of media.

But behind it all, is blockchain – a technology doesn’t yet have the everyday awareness, afforded to the likes of Bitcoin and Ethereum.

In reality, blockchain is a transformative technology, and cryptocurrency is just one of the utilities that it has the power to enable. Such is the potential of blockchain to support a digital revolution, that even cryptocurrency skeptics, are extremely bullish about blockchain and its holistic potential.

Blockchains store data in blocks that utilise chains to fuse them together into transparent, chronologically sorted data chains, that doesn’t require third-party intermediaries. The technology has the characteristics of being Immutable, Decentralised and Secure – but also has some potential advantages and disadvantages.

Key Insights:

- Blockchains store data in blocks that are chained to fuse them

- New data influx is stored in a new block

- Filled data blocks are chained to the previous block to store data chronologically

- Blockchain enables information to be shared without the ‘third party entities like banks or payment vendors

- Blockchain aims to enable unedited digital information to be stored and shared.

Immutability

- Transactions are permanently stored and viewable to everyone.

- Filled blocks are fixed & become part of the blockchain timeline

- Every block is timestamped when joining the chain.

- Blockchain control is collective to all users

Decentralisation

- The blockchain is created by decentralised computers in diverse geos

- Blockchain computers are operated by individual groups or people.

- The blockchain network of computers are called nodes.

- Decentralisation supports exact data transparency

Safety

- Fresh blocks are always saved linearly and in chronological order

- Each block contains a unique hash plus the hash of the preceding block & timestamps.

- Hash codes are generated by maths engine to encode alphanumerically

- Block = Hash (preceding block)+ Timestamp

Blockchain Advantages and Disadvantages

Advantages

Data Accuracy

Lower Cost

Decentralised

Efficient Transactions

Private Transactions

Secure Transactions

Transparency

Enhanced Data Management

Disadvantages

Technology Expense

Speed Inefficiency

Fraud Activity

Lack of Regulation

Blockchain Technology and Ledger

Ledger technology is vital to blockchain functionality, supporting a broad range of centralised and decentralised utilities.

Ledgers are utilised to store activities & verify the ownership and transfer of the value of assets. Ledgers are the key to blockchains ability to serve all stakeholders – including consumers, suppliers, producers and market makers.

Public Ledger

- A public ledger is a record storage ecosystem

- Ledger protects participants’ ID anonymously (pseudonymously)

- All transactions made on the network is stored.

- Scaling and security issues need refining for public ledger functionality.

- Mimics banking records without a central authority having access to ID of transactors.

Centralised vs Distributed (Decentralised)

When it comes to ledgers, there are two distinctions – Distributed (Decentralised) Ledgers and Centralised Ledgers.

Centralised Ledgers

Centralised (General) ledgers are owned and/or controlled by a central body. This type of ledger holds all of the owners’ equity, revenue, and expenditure.

- Bank accounts

- Hotel bookings

- National ID system

- Ownership of institutional securities

- Credit card transactions

- Businesses accounting systems

Distributed Ledger Technology (DLT)

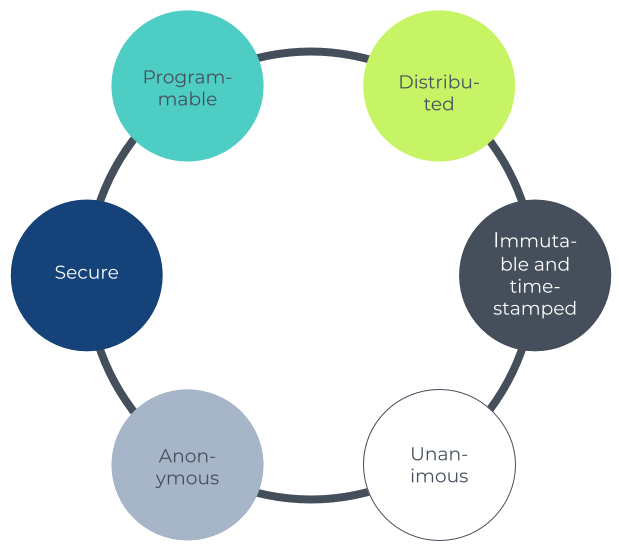

A distributed ledger (DLT) is a consensus of replicated, shared, and synchronised digital data, with no central administrator, and a diverse spread across locations, institutions and users. DLTs can be modified to send specific, timestamped data utilities, across a unanimous, anonymous and secure ecosystem – enabling diverse use cases, such as smart contracts, NFTs and Personal data storage.

Potential DLT use cases:

- Secure medical data

- NFTs

- Smart contracts

- Music royalty processing

- International payments

- Real-time IoT operating mechanism

- Personal ID security

- Anti-fraud and money laundering

- Supply chain and logistics control

- Voting systems

- Property sales processing platforms

- Advertising analysis

- Original content generation

- Cryptocurrency exchanges

Ledgers and Ownership

Cryptocurrencies and blockchain utilities, operate across a peer-to-peer (P2P) computer network (Nodes), with several key features:

- Nodes are used to process transactions and create & store ownership records.

- Anyone can become a Bitcoin node by downloading free open-source BTC software.

- Node equality means that no single node is trusted.

- Node systems work on the projection that that most computing power (over 51%) will be derived via honest nodes.

What problem does blockchain solve?

Distributed blockchains, face the problem of finding consensus in the presence of malfunctioning processes. Blockchains such as Bitcoin, continue to refine their processes to enhance consensus and ensure chain security and functionality.

- Reliable blockchain systems must manage the failure of one or multiple components when the chain either crashes endlessly, repeatedly re-boots, shuts-down, or goes byzantine (terminal damage).

- In the specific case of Bitcoin, the whole network has to agree on the secure and irreversible verification of transactions.

- Consensus is vital, since there’s always a chance of misinformation or miscommunication between peers, whether accidental or malicious.

- Distributed Ledger Technology and many other types of computer networks would malfunction without consensus.

- Bitcoin aims to solve the issue of consensus by ensuring 51% or more of computer power verifies transactions.

Blockchain Platforms

As the Blockchain industry evolves, we’re seeing more and more competition among projects, with many experts considering Bitcoin, Ethereum, Ripple, Cardano, Cosmos and Polkadot, as some of the key players in the industry. Each blockchain has its own governance rules, validation consensus, utilities and many more features such as Blockchain generation, energy consumption, smart contracts, DeFi and ID features.

As depicted in the Blockchain comparison table below by Technology Capabilities (BPC), there’s now a great deal of competition in the marketplace, with the later generation blockchains, having some distinct advantages over earlier projects. Naturally, there’s scope for many blockchain project to gain long-term success as they evolve, while evolution of green Bitcoin’s mining and its potential as a store of value, could still make it a sound long-term investment.

Blockchain features

- Governance rules

- Consensus validation

- Abilities/ best use cases

- Energy Consumption

- Deposit Times

- Transaction Fee

- Smart Contracts

- Decentralised Apps dApps

- Decentralised Exchange

- Decentralised Finance DeFi

- On-chain Governance

- Human Readable Address

- Digital Identity Management

- Data Privacy

- Cloud storage/computing

- Interoperability

- Cross-chain communication

- Automated Slashing

- Chain-Mainnet

- Chain Security Model

- Scalability options

Blockchain Platforms Comparison (BPC) table, by Martin Holovsky.

DeFi is one use case for blockchains, that has a potentially huge future. One prominent example, is Uniswap, which runs on Ethereum blockchain and and acts as a liquidity provider. When Uniswap liquidity providers, deposit liquidity (ETH/USDT + native tokens) into a Uniswap pool, new tokens (Liquidity tokens) are generated to the provider’s address. Blockchain trades, generate a 0.3% fee that is paid-out pro-rata, to all liquidity providers in the pool, when the trade occurs. Uniswap holders can also hold, trade or stake their tokens, however they like in viable pools.

Blockchain Cryptography

Blockchain cryptography is vital to data security. The core principle used, is cryptographic hashing –a concept that uses mathematical coding to validate data integrity, by changing identical data into a unique, representative, fixed- size code. Accidental or nefarious changes to the data, will entirely alter the hash code, stored under Digest.

Hash: A hash is a process that changes an alphanumeric input into a systematic encrypted output.

Cryptographic hash functions

Hash functions are vital to blockchain, providing cryptographic security for passwords and immutability:

- Hash functions are often used for passwords.

- Hash functions are fundamental to blockchain technology and enable immutability.

- Solving the hash begins with the data stored in the block header.

- Each block header holds a version number, a timestamp, the hash used in the preceding block, the hash of the Merkle Root, the nonce, and the target hash

- Satoshi removed O0lI characters from Bitcoin hashes, to make it simpler.

Bitcoin Hash Keys: Private vs. Public Keys

Private Keys and Public Keys provide different types of features and functionality, optimising security across the blockchain:

Private key (Privkey) is created at random and is 100% secret.

- With Bitcoin the Privkey is It is used by the current owner to digitally sign a BTC transaction, authorising transfer to a new custodian.

- A transaction’s digital signature verifies ownership & and ca verify transaction authenticity.

Public key (Pubkey) is created from the Privkey using a one-way cryptographic hash

- The Pubkey is used by the new custodian to verify a transaction’s digital signature.

Blockchain Investing

Blockchain evolution is happening at a rapid rate, with big businesses, governments, SMEs and individuals, all making moves in the scene. While some blockchain projects are already underway, including governments tracking vaccine data via the chain, the industry remains in its infancy.

This offers investors a potentially very interesting industry to delve into to – but also a volatile one, with potential risks. On paper, crypto assets such as Bitcoin and Ethereum, have performed very well in the last year, in terms of overall value gains. However, the volatility of May 2021’s market correction, illustrates the need for investors to understand the risk and rewards when it comes to blockchain speculation – be it short term trading, or going long as a holder.

The easiest way to speculate on blockchain, is to add well known blockchain-based cryptocurrencies to your portfolio via an exchange such as Coinbase. Coins such as Bitcoin and Ethereum remain logical options with long-term potential, while alts such as Cardano, Polkadot, Cosmos and Ripple, are others that continue to perform with interest.

Many more alt coins and projects are also rapidly emerging in the space, creating a depth of potential for traders and long-term digital asset investors.

Other blockchain investment options, include blockchain ETFs and mutual funds.

Blockchain investing is definitely a niche that has huge potential, but keeping a close eye on industry developments, breaking news and market performance, is essential for long-term success.

Blockchain FAQs

Understand the fundamentals of the chain, with our blockchain FAQs: