Free Crypto Course Session 3: Altcoins & Crypto Services

Altcoin Definition

Altcoins are all other alternative cryptocurrencies other that are not bitcoin.

Key Points

- An “alt-coin” is a form of payment that is based on the basic concepts of Bitcoin but differs or improves in its execution.

- Many people have developed their own “alt – currencies,” with their own laws and networks.

- Some older concepts, such as Ripple, have been enhanced by blockchain innovation and have grown into their own entities.

- While some are minor tweaks to the Bitcoin protocol with a small audience, others are intriguing sources of innovation.

- Although Bitcoin is the king, several alt-coins have received a lot of acceptance.

- These new coins have different attributes and generate their own blockchains that are independent to the Bitcoin blockchain, using the original open source software with a few modifications.

Best Known Altcoins

- Currently more than 5,000 altcoins

- Some of the best-know coins are: Ethereum (ETH), Litecoin (LTC), Cardano (ADA), Polkadot (DOT), Bitcoin Cash (BCH), Stellar (XLM), Chainlink, Binance Coin (BNB)

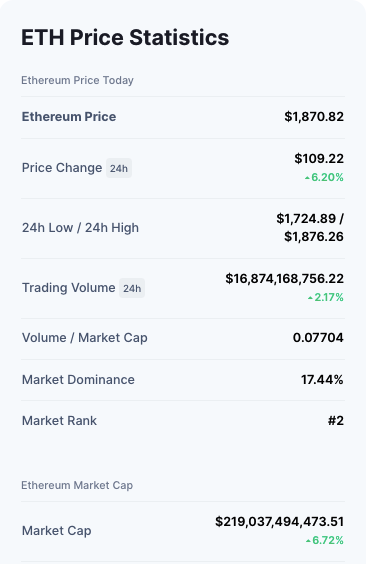

Ethereum (ETH)

- Ethereum is one of the most popular and globally founded projects.

- Ethereum’s goal is to establish a decentralised range of financial opportunities that anyone in the world, regardless of nationality, ethnicity, or beliefs, can use for free.

- The Ethereum blockchain may run any decentralised application’s programming code.

- Rather than having to create a new blockchain for each new application, Ethereum allows developers to create several applications on a single platform.

- Ether is the cryptocurrency of Ethereum. It is mined and fuels the network.

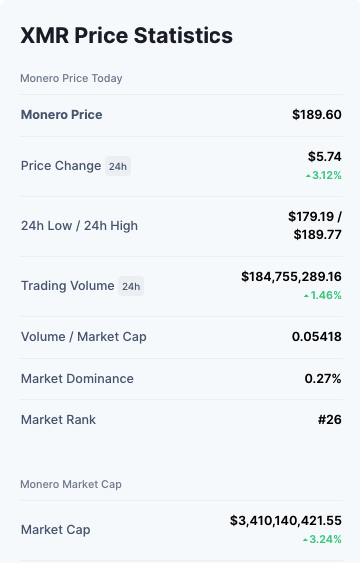

Monero (XMR)

- Monero saw the light in 2014, initially as a fork of Bytecoin.

- Monero allows its users to select to selectively disclose their transactional history to selected parties.

- It has always focused on providing strong privacy while offering optional transparency.

- Monero has a dynamic fee mechanism and a changeable block size.

- It employs an encrypted public ledger, which allows anyone to send or record transactions while keeping the source, amount, and destination hidden from outside observers.

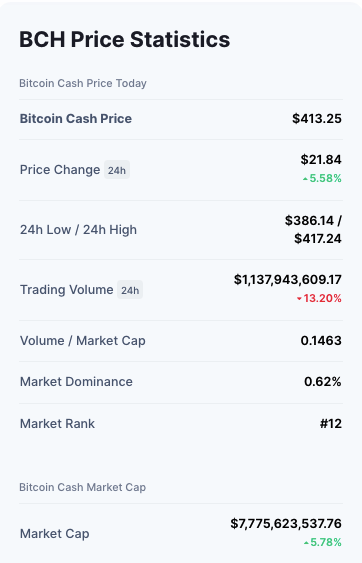

Bitcoin Cash (BCH)

- Bitcoin Cash was created as a result of a fork from Bitcoin.

- It was established in 2017

- This blockchain’s block size is 8 MB.

- Miners can earn more transaction fees if there are more transactions in a block.

- Approximately 2 million transactions may be handled each day, compared to 250k transactions per day for Bitcoin.

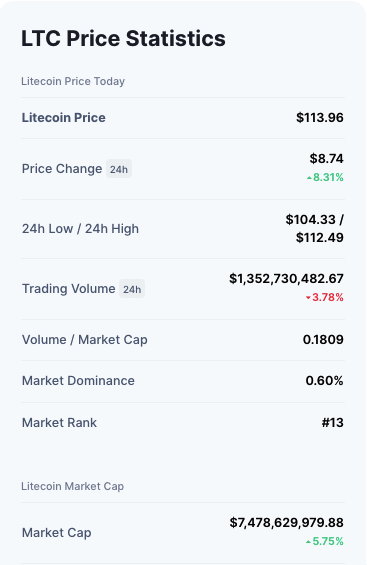

Litecoin (LTC)

- Litecoin is an open-source software project and a peer-to-peer cryptocurrency.

- Starting in October 2011, it was an early bitcoin spinoff or cryptocurrency.

- Litecoin is nearly identical to Bitcoin.

- In comparison to Bitcoin’s 10 minutes, the Litecoin Network promises to process a block every 2.5 minutes.

- As a result, Litecoin can confirm transactions significantly more quickly than Bitcoin.

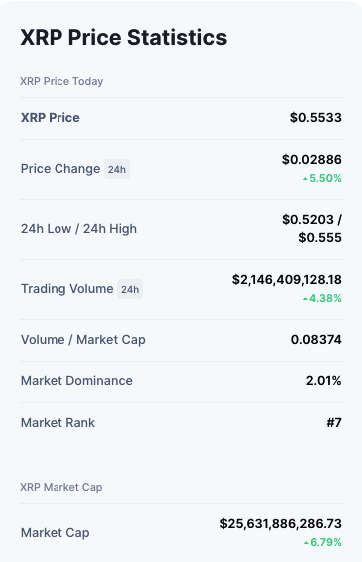

Ripple (XRP)

- Ripple is a distributed open source protocol that supports tokens representing fiat cash, bitcoin, commodities, or other units of value such as frequent flier miles or mobile minutes.

- It was launched in 2012 and is based on a distributed open source protocol.

- Ripple claims to be able to facilitate “secure, instantaneous, and almost free worldwide financial transactions of any size with no chargebacks.”

- The native cryptocurrency of the Ripple Ledger is XRP

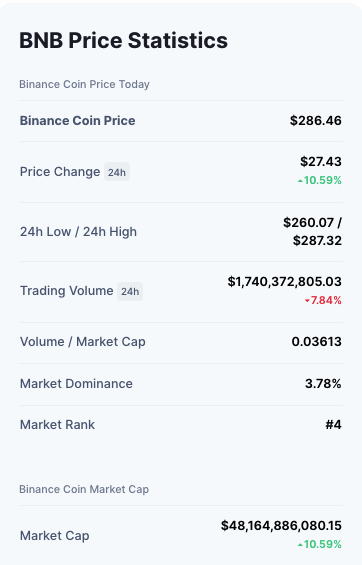

Binance Coin (BNB)

- Binance Coin (BNB) is a the official cryptocurrency of the Binance crypto exchange.

- Binance Exchange is one of the most popular crypto exchanges in the world,

- Binance accepts and trades other major cryptocurrencies like, such as Bitcoin, Ethereum, Litecoin, etc.

- BNB was launched in 2017 and worked with the ERC-20 token on the Ethereum blockchain before becoming the native currency of Binance’s own blockchain, the Binance Chain.

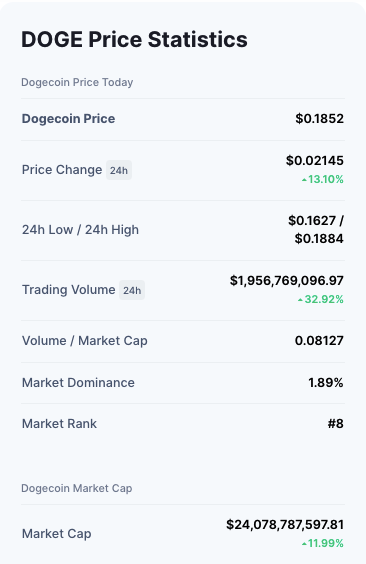

Dogecoin (DOGE)

- Dogecoin was created as a fun and unconventional payment system.

- The logo of Dogecoin is the face of the Shiba Inu dog from the “Doge” meme, reinforcing the “fun” concept behind DOGE

- Lauched in 2013, it quickly became a fan favourite

- Dogecoin’s block time is 1 minute as opposed to Litecoin’s 2.5 minutes.

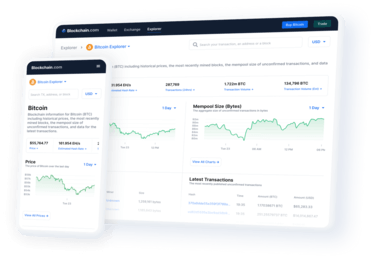

KPI’s for Cryptocurrencies

Market Capitalisation

- Market capitalisation is a term that calculates and tracks a cryptocurrency’s market worth.

- This metric compares the current value of each coin to major conventional (fiat) currencies.

- It is determined by the current price * by the circulating supply.

Print Date: 21st July 20210 – Source: Bitinfocharts.com

Volume (24h)

- The trading volume measures the number of coins that have been traded and/ or exchanged in that particular time period, usually 24hours.

- The 24-hour trading volume of a cryptocurrency refers to how much of a coin’s value has been bought and traded in a single day.

Print Date: 21st July 2021 – Source: Coinmarketcap.com

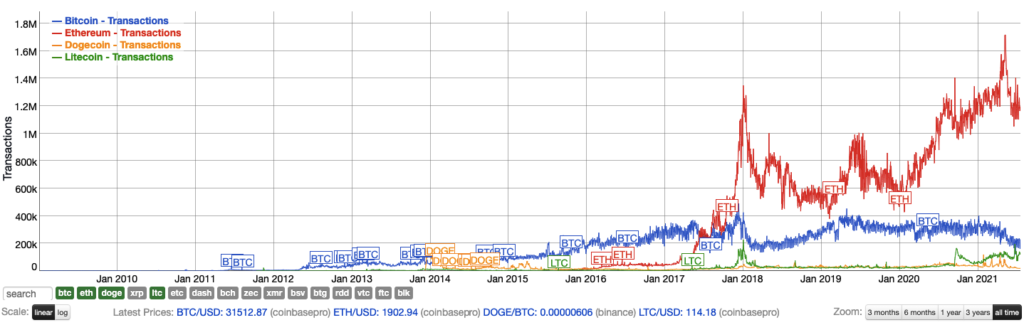

Transaction Volume

- Measures the number of transactions that have happened over time as well as the amount of coins involved in said transactions

Print Date: 21st July 2021 – Source: Bitinfocharts.com

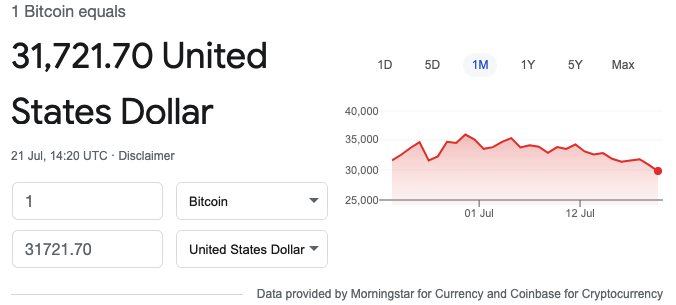

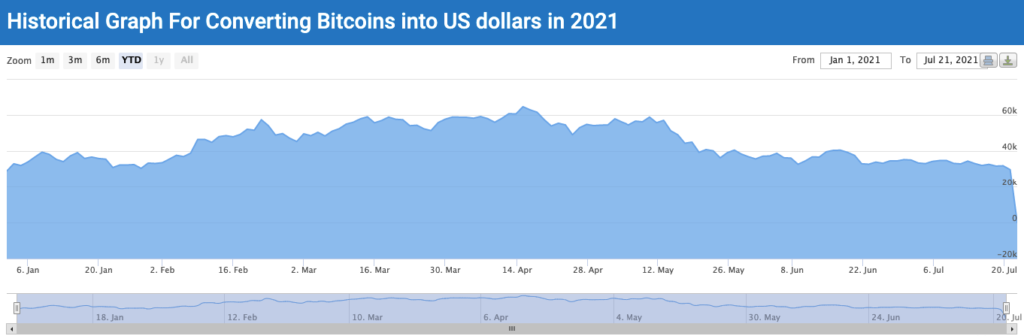

Exchange Rate

- The value of one currency in relation to another.

- An exchange rate is the rate at which one national currency is exchanged for another.

- Exchange rates can be fiat vs. fiat, crypto vs. fiat or crypto vs. crypto.

Print Date: 21st July 2021 – Source: Google

Print Date: 21st July 2021 – Source: Poundsterlinglive.com

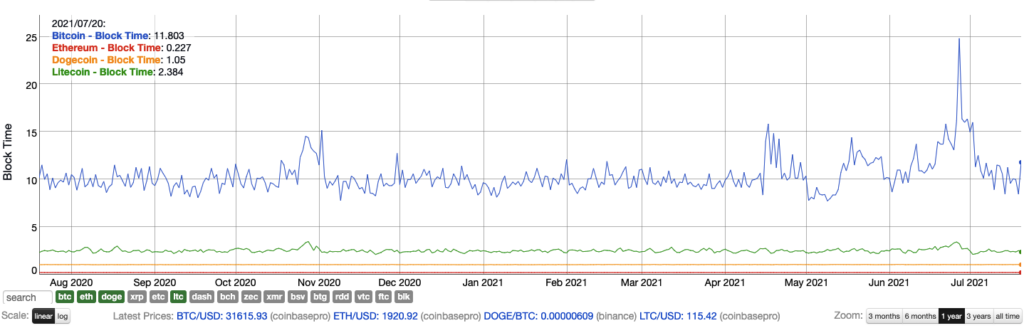

Average Confirmation Time

- The average confirmation time, also known as block time, is the time it takes for a transaction to be confirmed on the blockchain.

- The confirmation time of Bitcoin is about 10 minutes. Newer cryptocurrencies have a much lower block time.

Print Date: 21st July – Source: Bitinfocharts.com

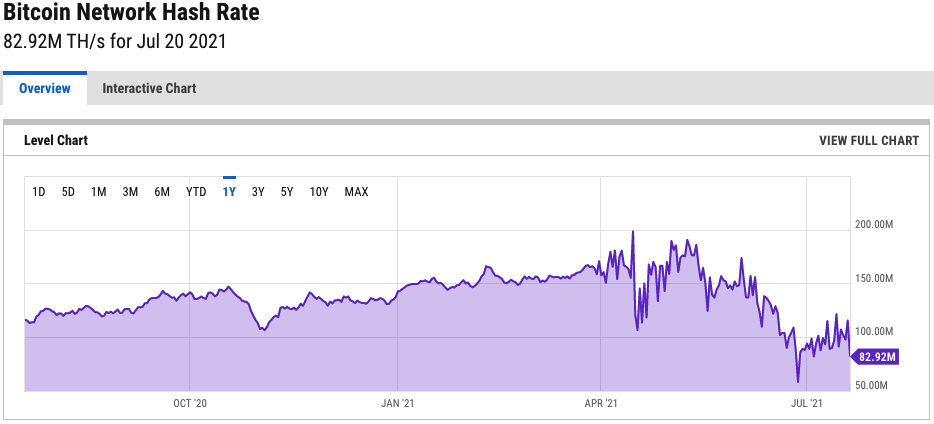

Network Hash Rates

- This metric is the network’s processing power.

- It gives an indication of the current difficulty in the mining process.

- Difficulty refers to the complexity to generate a SHA-256 hash for a candidate block.

Print Date: 21st July – Source: Ycharts.com

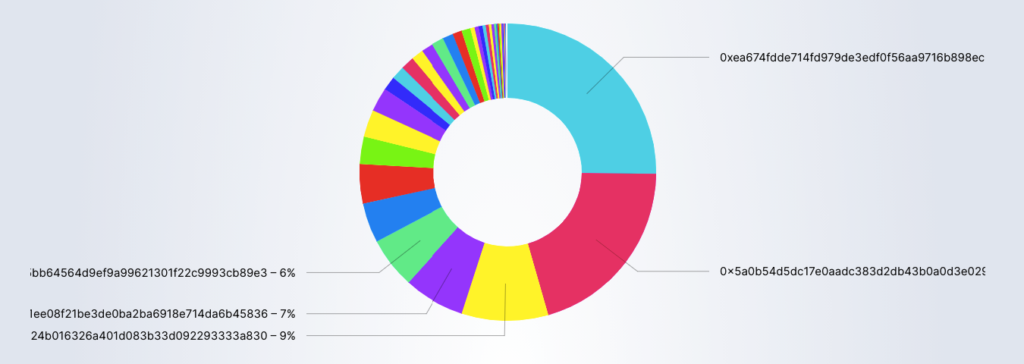

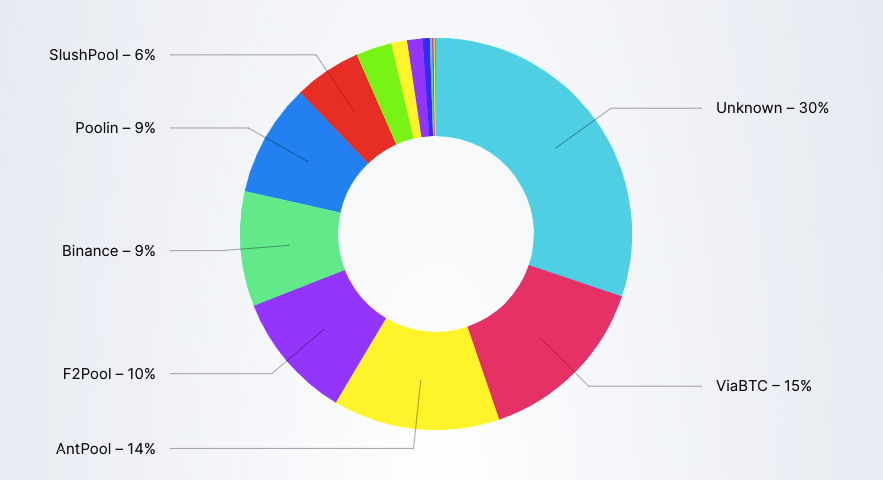

Hashrate Distribution

- With the Hashrate Distribution you can identify the biggest mining pools and their contribution to the whole blockchain.

- This metric is never 100% accurate and it should only be used as a rough estimate.

Print Date: 21st July – Source: Blockchair.com

Print Date: 21st July – Source: Blockchair.com

Foundational Financial Services of Crypto

- The following are the basic components of cryptocurrency financial services:

- Cryptocurrency Exchanges

- Crypto Wallets

- Merchant Processing Services

- Once properly established and integrated, they will become the core of the payment system.

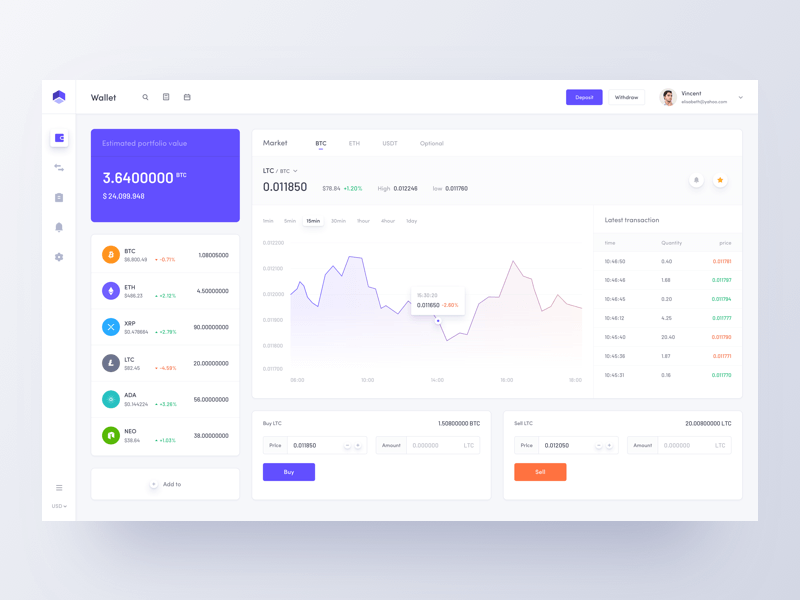

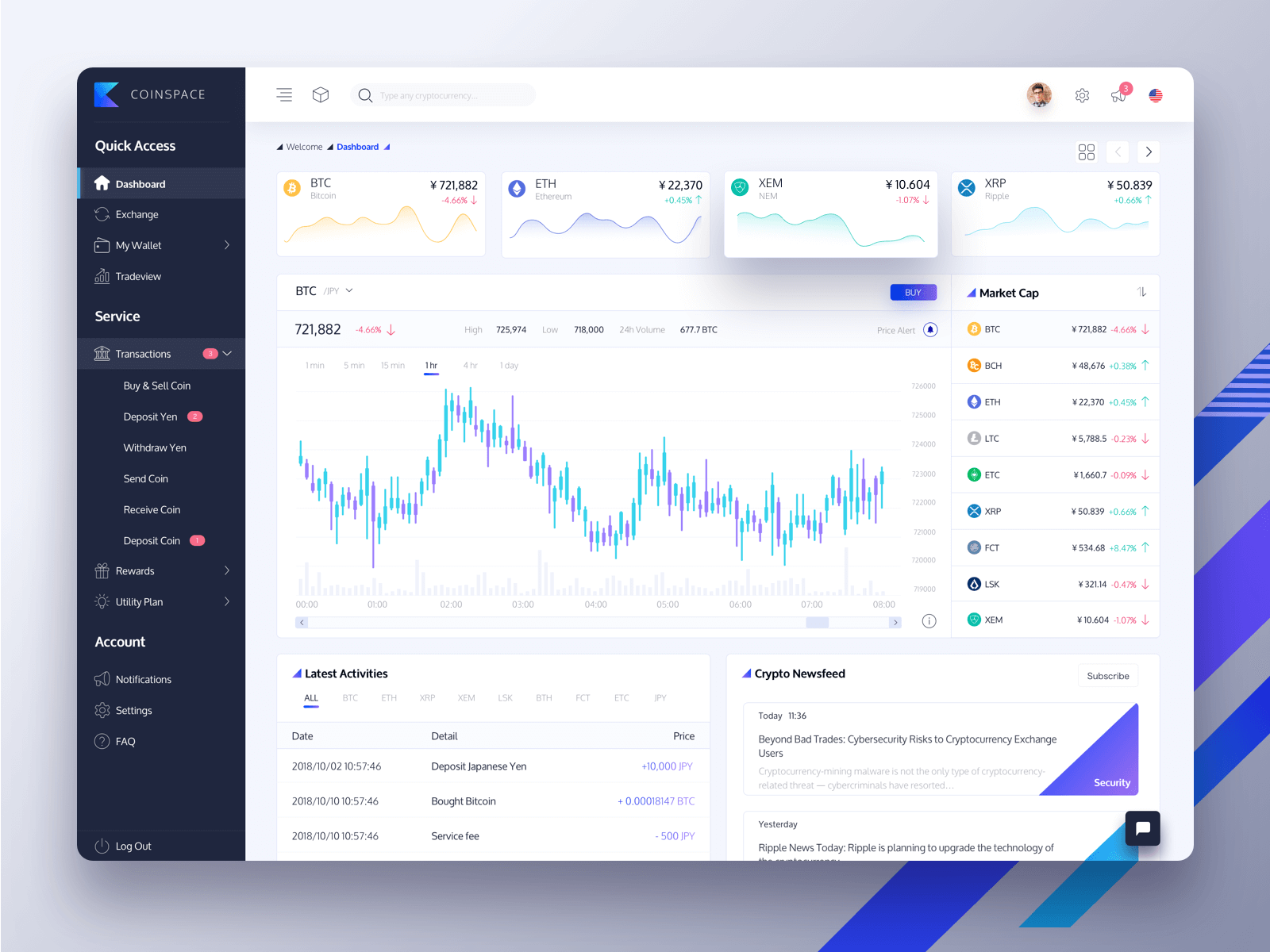

Crypto Exchanges

It’s an online marketplace where traders can buy and sell cryptocurrencies using fiat and/ or digital currencies.

Key Points

- A crypto currency exchange is an online platform where you can exchange and trade cryptocurrencies.

- It acts as an intermediary between buyers and sellers, or to use crypto terminology, between a “maker” and a “taker.”

- A bitcoin or crypto exchange works like a stockbroker, you open an account and you can deposit money via bank transfer and other popular deposit methods.

- It works similarly to exchanging money at a bank or exchange bureau: you will pay a currency conversion fee and, in exchange, you will get your new currency.

How it Works

- The first step to start trading and exchanging cryptocurrencies is to open an account with a selected crypto exchange and pass the verification process.

- After this initial authentication process, verified users can fund their crypto exchange to start using the digital platform.

- You can deposit funds with different payment methods, check your exchange to see which ones are available for you.

- In order to withdraw funds, you can do so by choosing from one of the available payment methods.

Special Considerations

- Fees

- Some crypto exchanges might charge fund transfer fees, when making deposits and withdrawals. This also depends on the payment method chosen to transfer funds.

- In cases where your own currency is not accepted, you might have to pay conversion fees.

- As a general rule, most of the crypto exchanges have transaction fees, that apply after each completed buy and sell order.

- Important: Crypto exchange is NOT a crypto wallet.

- The crypto exchange is a trading platform, the crypto wallet is a digital storage service only.

- Most crypto exchanges also offer wallets, but they might charge a fee for this addition service.

Most Popular Crypto Exchanges

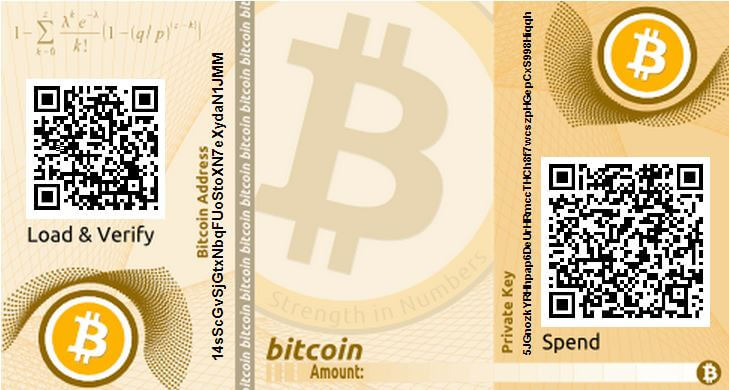

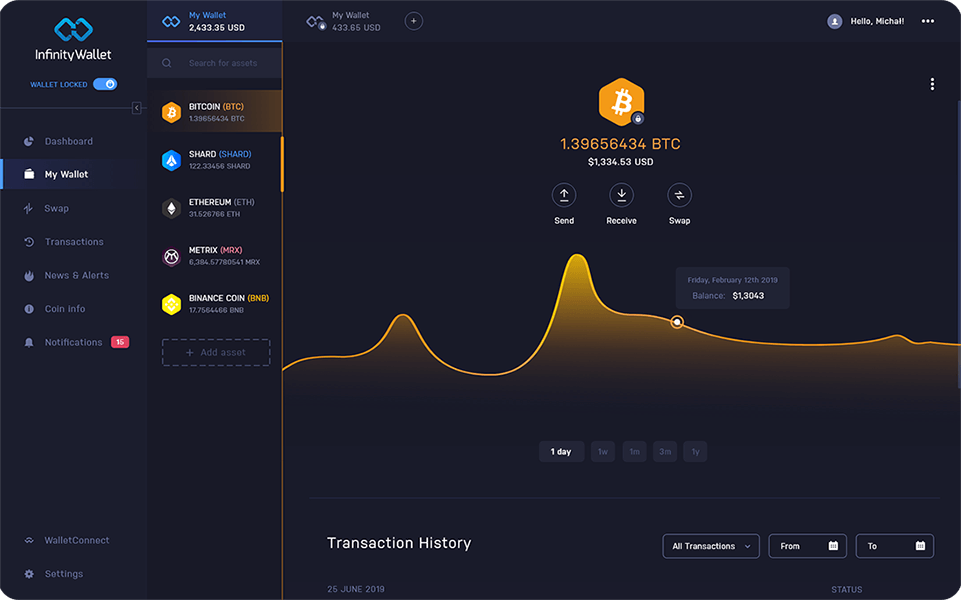

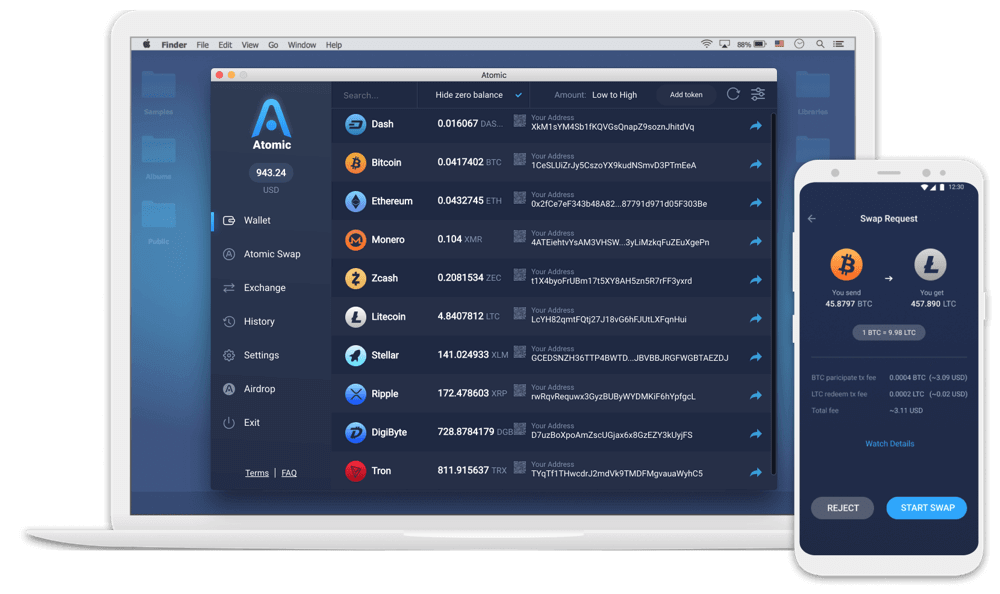

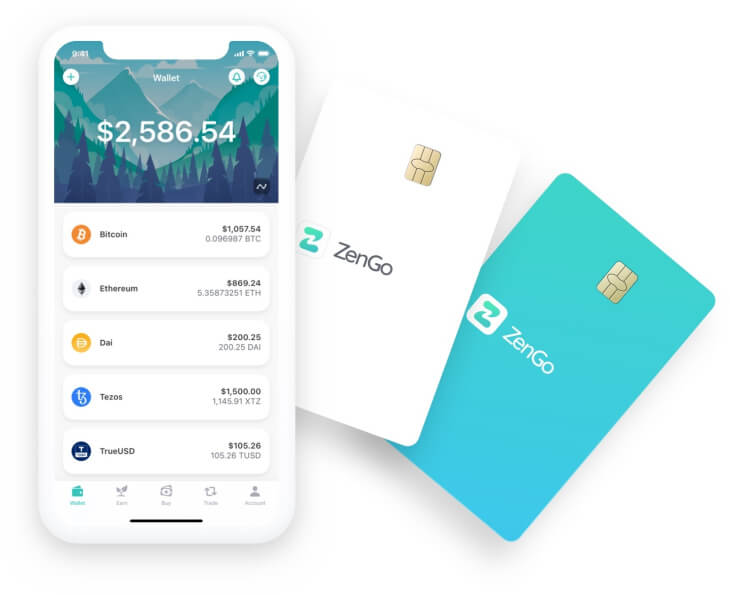

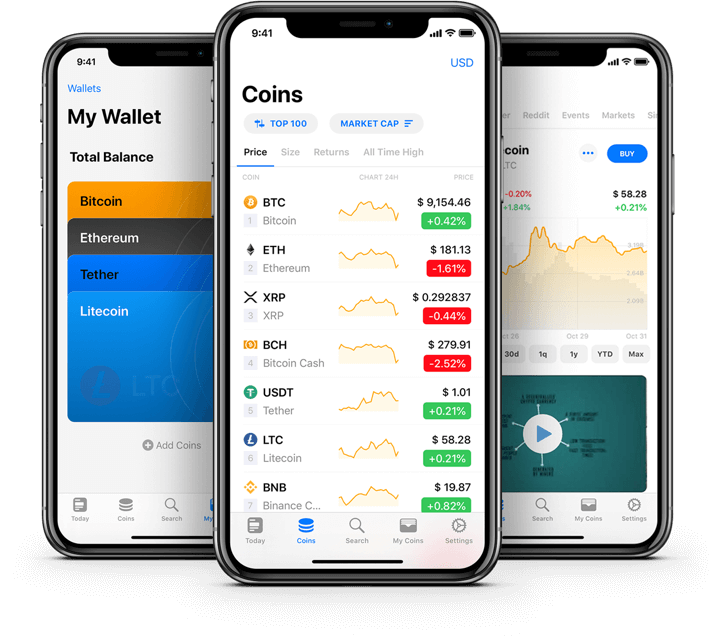

Crypto Wallets

A cryptocurrency wallet is a storage system that holds your public and/or public keys. It can be a physical device, digital program or paid online service.

A wallet is software that holds all your addresses. Use it to send bitcoins and manage your keys. […] A wallet is simply a collection of addresses and the keys that unlock the funds within.

Key Points

- Since cryptocurrencies are fully digital, you will never be able to hold a physical bitcoin or altcoin, so, in order to store them, you will need a private key.

- Crypto wallets don’t really store your cryptocurrencies; instead, they store your private key, which gives you access to all of them.

- There are 5 types of crypto wallets:

- Hardware wallets

- Paper wallets

- Desktop Wallets

- Mobile Wallets

- Web Wallets.

Hardware Wallets

- A physical piece of hardware that can be used to store your cryptocurrencies.

- Hardware wallets are also referred to as cold storage and non-custodial.

- It is the safest type of wallet as it’s an offline storage.

- You plug it to your computer when you need to manage your funds.

Paper Wallets

- A paper wallet is a printed version of your key, which contains the key itself and a QR code, which is used for transactions.

- It’s also an offline storage wallet, and, thus more secure than online options, but it’s also easy to loose and it an fade with time.

- It is now an outdated type of wallet.

Desktop Wallets

- Desktop wallets are installed on your computer, need internet access and provide control over you wallet from your device.

- They work as an address for the user to send and receive crypto.

- You can also store your private key.

Mobile Wallets

- Mobile wallets or wallet apps, are wallets downloadable on your mobile phone.

- Most desktop and online wallets come with the mobile app as well.

- Some crypto exchanges include a mobile wallet, and vice-versa.

- Since it’s an online platform, it’s a custodial wallet and hot storage.

Online/ Web Wallets

- With online wallets, you don’t need to download any software to your computer or phone, meaning you can connect anywhere, anytime.

- Unfortunately, the main drawback is that it’s more vulnerable to hacking, than other wallets.

Cold vs Hot Storage

Cold Storage

- It is disconnected from the internet, completely offline, making it the safest crypto wallets.

- Cold storage wallets include: Hardware wallets (physical devices, like a pen drive) and paper wallets.

Hot Storage

- Hot wallets are the best option if you’re currently trading or exchanging crypto.

- Connected to the internet

- Hot wallets are vulnerable to online hacking, change in regulations and technical difficulties.

Custodial vs Non-Custodial

Custodial

- A custodial wallet keeps your private keys and digital assets safe, meaning you can always recover. It offers a backup.

- If you lose your private key, you can always recover it.

- It offers, for most parts, free and instant transactions.

Non-Custodial

- Non-Custodial wallets means that no one else, except you, own your private key.

- It is the safest way of owning crypto, since it’s not connected to the internet, it’s safe from external cyber attacks.

- But a los wallet, also means total loss of your funds and crypto.

- Non-custodial wallets are cold storage, like hardware and paper wallets.

Merchant Processors

Merchant processors allow business to accept cryptocurrencies as payment method.

Key Points

- They are the equivalent to fiat currency merchant processors (First Pay, WorldPay, Elavon, Authorize.net, Square, etc) for the most popular payment methods (Visa, Mastercard, American Express, etc).

- They include the integration into the business’ website and shopping cart, and the conversion into legal tender after the purchase.

- Common payment systems use a “pull” mechanism, in which they take funds from your account and route them via a vast and complicated network.

- With bitcoin payments it’s different, as only two parties have access to the transaction and only at the time that it’s being made. This is called a “push” mechanism.

Likely Initial Areas For Adoption

- Online Products: affordable merchant fees for vendors

- Sensitive Products: HIV tests, pregnancy tests, pornography, etc.

- High-Risk Vendors: giving access to their credit card/credit line to “risky” vendors.

- International Customers: chargeback frauds are avoided due to the irreversible nature of cryptocurrency transactions.

- Open Bazaar : It’s a peer to peer e-commerce application, that it’s expected to grow in popularity paving the way for similar e-commerce sites.